Bangkok, Thailand.

Looking for alternative economic recovery strategies

With nearly 20 percent of Thailand's pre-Covid crisis GDP related to tourism, the partial reopening of country's borders on November 1 to international tourism was a risky move aimed at turning around the economy.

There has been a whole range of guesstimates made by the Tourist Authority of Thailand (TAT) about how many tourists will visit Thailand in 2021 and 2022, that have been optimistically predicted. However, these have been based more on hope than the reality of an unpredictable tourism environment because of surging worldwide Covid-19 cases and corresponding border restrictions across much of the world.

The partial opening of borders to visitors from 63 countries, comes at a time when bars, entertainment businesses remain closed across the country, and restaurants in most parts of the country are not allowed to serve liquor with meals.

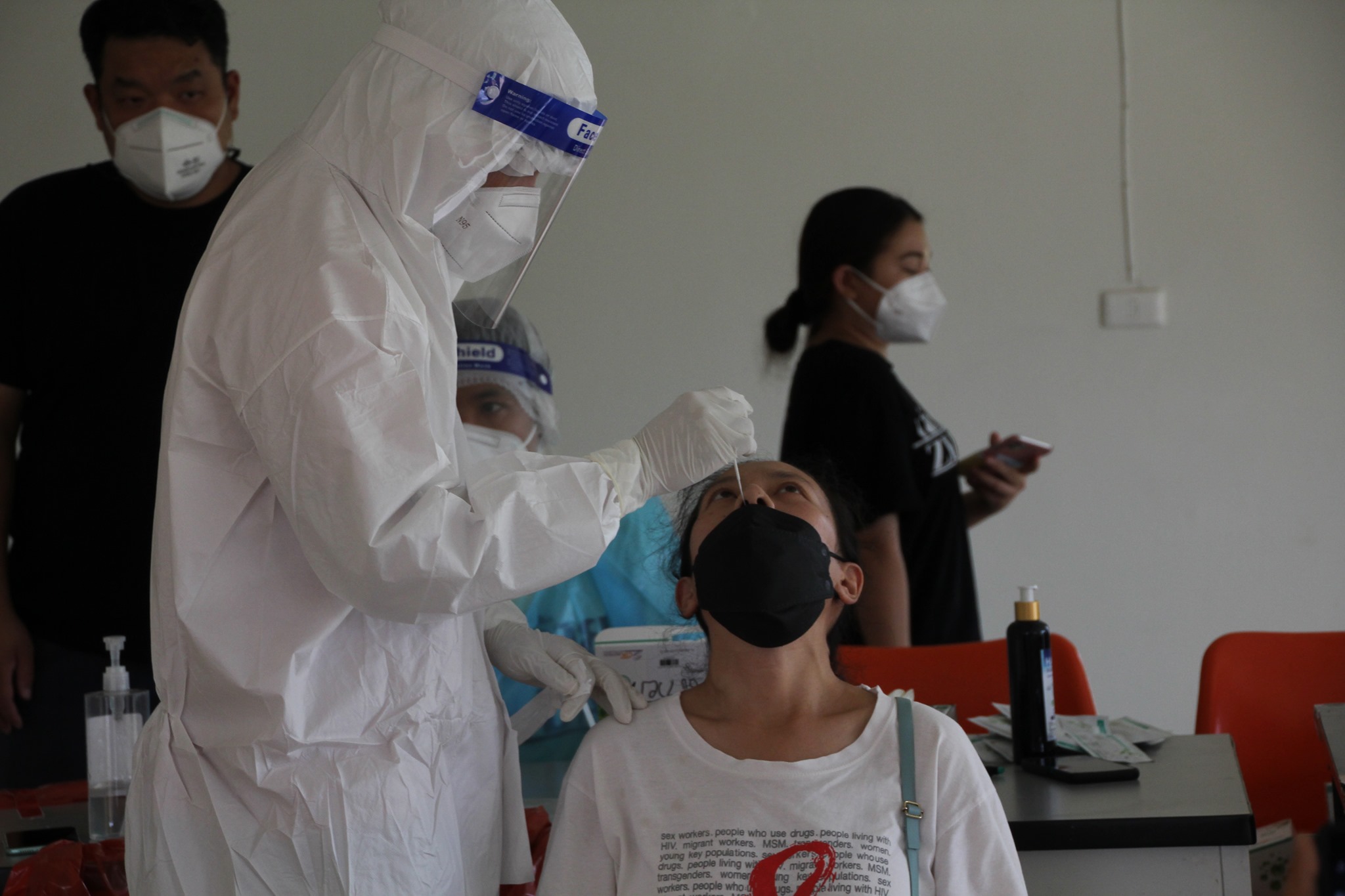

The supposedly quarantine free entry for fully vaccinated foreign visitors, has been found not to be completely true as visitors are required to stay in isolation up to 30 hours in hotel quarantine, until their Covid test results come through. There is a host of paperwork and procedures required to enter Thailand, which include full vaccination certificates, a pre-paid hotel booking, USD 50,000 health insurance policy covering Covid-19 and the Thailand Pass, applied for online. The Thailand Pass website has been criticized by applicants for glitches and approval delays. As on November 4, some 50,000 applications were made, with 12,607 approvals.

Since the relaxation of restrictions on November 1, there have been 30,000 visitors arriving in Thailand. This is negligible compared to the volume in 2019, when nearly 40 million tourists arrived. However, there are reports that a sizeable number of visitors are not tourists, but expatriate residents returning to Thailand. A 2010 study estimated there were 2,581,141 expatriates in Thailand, with 80,000 new retirement visas issued inside Thailand in 2018. This doesn't include long-term visas issued by Thai embassies abroad.

The November 1st partial opening of Thailand for international tourists is the third attempt since the end of 2020. The Special Tourist Visa (STV) had only lukewarm success, and the Sandbox program centred on Phuket and later Koh Samoi attracted 38,000 visitors between July and end of September, once again this number representing a sizeable proportion of returning expatriates.

The reopening of Thailand to international tourists is considered a major risk with the relatively low vaccination rate. Only 49.1% of the total population fully vaccinated as at November 8. A survey by Suan Dusit Rajabhat University of 1,392 respondents found that 59.86% rejected the plan of reopening Thailand for international tourists, while 60.10% said it was not the right time to open the country.

A recession causing many extreme hardship

Thailand is a very different country than it was before March 2020. GDP plummeted 6.9% in 2020, with an estimated 2 million people thrown into unemployment. There are many more underemployed within the large informal sector. Accommodation, food services, entertainment, and transportation sectors were the worst hit, indicating the importance of tourism to the country.

Areas that relied upon tourism like Phuket, Pattaya, Hua Hin, Hat Yai, and Chiang Mai resemble ghost towns in parts, with many businesses closed down permanently. Over the last couple of months, a bout of rising prices for staples and petrol is giving concerns about inflation, with 2.38% price increases in October 2021. With poverty estimated by the World Bank at 6.4% and on the rise, inflation will add to the problems of the poor across the country.

Covid-19 cases across the country have been gradually declining over the last month to around 7,000 cases per day, with deaths now under 100 per day. Although vaccination rates around tourist regions like Bangkok, Phuket, Koh Samoi, Phang Nga, and Chonburi are around 70% of the total population, other areas are significantly lower. Cases within the four southern border provinces Songkhla, Patani, Yala, and Narathiwat are still very high, where there is a growing resistance to vaccinations by segments of the local population. With no declining trend in cases on the horizon, it will be very difficult to see many Malaysian tourists coming to Thailand. In 2019, 4 million Malaysians, or 10% of Thailand's foreign visitors came across the Malaysian-Thai border to visit Thailand.

A revival in international tourism may take some time

A return to the pre-Covid tourist numbers is most probably out of the question for a number of years. Like China, many countries are restricting the travel of their nationals for holiday purposes. In addition, there are a number of factors inside Thailand that could hinder a revival of tourism in the foreseeable future.

TAT predictions of between 10-18 million tourists arriving in Thailand during 2022 must be taken with a grain of salt. TAT's focus on attracting the super wealthy seems to be based on just an idea rather than market research, as are ideas to attract first time tourists, and wealthy Indian tourists. The limited Phuket sandbox opening back in July this year failed to filter much spending down to the small ancillary businesses that support tourism such as entertainment, massage shops, and small restaurants. Super wealthy tourists will only assist the super-deluxe five star resorts, most owned by large corporations, and not much else.

Traditionally, most tourists coming to Thailand have tended to be price sensitive. Thailand has historically been the destination of backpackers, middle income holiday makers, with a small percentage of super wealthy tourists. There are now countries like Vietnam, Indonesia, and even Malaysia that are very competitive with Thailand. The Caribbean, Latin America, and Southern Europe are attracting tourists from Europe this year due to their competitiveness and relative ease of entry into each country.

Thailand's greatest barrier to expanding international tourism is its own bureaucracy. Government agencies have created cumbersome requirements on prospective tourists who want to holiday in Thailand. In addition, the process of entering Thailand has become, from recent reports very risky. If a visitor has a positive Covid test upon arrival, or a negative test, but was sitting near someone who had a positive test, they will be placed in 14 days quarantine, at their own expense. This was not advertised at the time of opening borders. Local media reports claim this has cost some visitors between Baht 50,000 to one case, a local hospital charging Baht 350,000.

The relatively high costs of Covid tests at the airport, the extra Baht 500 entry chargeinto Thailand in 2022 that will be collected from a booth upon arrival, media stories of tourists being assaulted, raped and murdered, dual pricing, and taxi scams are slowly eroding the good reputation of Thailand as a tourist destination.

With the future of international tourism bleak, there is a need to consider alternative strategies to rehabilitate the Thai economy, and create new employment opportunities.

Revitalizing domestic tourism

The government encouraged focus on domestic tourism in 2020, which saw 2.23 million domestic tourists take local holidays during March 2021, before the upsurge in Covid cases in April, after the Songkran holiday period.

While many of the traditional tourist areas have been bypassed, new regions showed they were popular with Thai tourists. These included areas which have developed eco and farm tourism attractions with resort style food and accommodation. Adventure activities like rafting have sprung up along rivers, along with pontoon stays on lakes, and scenic restaurants with food catering specifically for Thai tastes.

While most 'red light' districts have become desolate, border towns like Betong, in the Deep South, have reinvented themselves as weekend getaways for big bike and family groups. The winners of the surge in domestic tourism were adventure orientated SMEs, many made up of people who were involved with foreign tourism, and family-owned boutique hotels and eco-resorts. Many hotels that serviced tourism have either reopened as apartments, or become hospitels for Covid quarantine.

When provincial rules for domestic travel are streamlined and Covid case numbers decrease to acceptable levels, domestic tourism is set to resurge beyond March 2021 figures again. It's probable that there could be more than 25 million domestic tourists in 2022. Domestic tourism will distribute spending across the country into the hands of SMEs and family businesses.

Manufacturing must become the main engine of growth

The bright hope for the Thai economy is manufacturing. Manufacturing, along with the production of agro-based foods have been the major drivers of Thailand's increase in exports. Thailand's exports rose 20.71 percent year-on-year to July 2021, where manufacturing played a major role in that figure.

With the Thai Baht weakening 10 percent against the US Dollar over the year, Thai manufactured products are becoming more competitive. The challenge is for Thailand to diversify its manufacturing base and attract new manufacturers which want to leave China to evade US and EU sanctions on Chinese manufactured products.

Rayong is an industrial zone set to grow with deep port and international airport access. The former red-light border town of Dannok in Songkhla is transforming into an industrial town with numerous Malaysian companies ready to set up in the new SEZ industrial park there.

Manufacturing made up 25.23 percent of Thailand's GDP in 2020. Manufacturing is set to become one of Thailand's main growth engines over the next couple of years.

Agriculture is keeping rural communities buoyant

Although agriculture represents only 8.44 percent of Thailand's GDP in 2020, it's been a very important activity to keep many rural communities immune to the financial hardships of the Covid crisis.

With rubber prices improving over the last 12 months, some 1.7 million families have been able to continue as normal collecting latex and selling their produce on a daily basis. This income has been flowing through local communities who service rubber tappers with food stalls, sundry shops, and other services.

Fruits and market vegetables have also been excellent crops with strong local demand. Agro-based food product exports have risen 24.71 percent year-on-year to July 2021, bringing a boom to producers of crops like durians.

Many ex-tourism workers have turned to farming and finding it lucrative. Market gardeners have devised innovative business models that utilize online sales platforms for home deliveries.

Retraining unemployed for other careers

Many unemployed workers have returned to their home provinces to set up food stalls or other micro-enterprises with varying success. Those in rural areas that are buoyant with agricultural activities are able to make a meagre living. Those in urban areas who set up small food stores can utilize food delivery apps to widen the reach of their food stalls. However, not all are successful. Those who have opened up coffee stalls or hair salons in saturated markets, usually end up closing down very quickly.

Some unattractive jobs pre-Covid like caring for the aged have become popular. There are 13 million people aged 60 or above in Thailand today, about 20 percent of the population. By 2050, those over 60 is expected to rise to 20 million, making up 35.8 percent of the population. Caring for the aged and infirmed is a growth industry with a shortage of carers. TVET providers are training up unemployed and guaranteeing them placements across the country.

TVET education needs strong promotion among unemployed to assist retraining to fulfil new working roles in society.

Revitalizing the One Tambun One Product (OTOP) programs

There are 2.9 million SMEs in Thailand, employing 9.7 million people, while contributing 37.2 percent to GDP. The One Tambun One Product (OTOP) program introduced in 2001 by the former Taksin Shinawatra government assisted in the created of 36,000 OTOP development groups which created provided skill and product development programs, access to micro-finance, and connection to markets. OTOP was hailed a success and developed a trustworthy brand franchise Thai consumers recognize.

Its time to revitalize the OTOP program framework to cope with the unemployed created through the Covid crisis. With the boom in online sales and marketing platforms, the OTOP framework for creating new SMEs to add value to the economy from those presently unemployed.

Reopening international tourism is not the silver bullet that will kick-start the floundering Thai economy in the immediate future. New drivers including domestic tourism, attracting more manufacturing, revitalizing agriculture, increasing TVET retraining, and reintroducing the old OTOP platforms and training frameworks are desperately needed for assist in economic recovery.