Prime Minister Srettha Thavisin couldn't be clearer: "You should pay tax on income you earn no matter how you earn it." He was referring to the revenue department's "clarification" that, from January 2024, it planned to the tax foreign income on all individuals, Thai or foreign, who have resided annually in the country for over six months. The department's statement specifically closed the loophole, under existing law, that anyone could escape the tax by delaying transfer of the funds until a later tax year, for example by holding it in offshore funds.

It is commonly understood that the incoming Pheu Thai government must raise mega-funds for its welfare policies, for example the US$16 billion (560 billion Thai baht) wallet scheme to pay 10,000 baht to all adult Thais as a regenerative economic move. However, the policy has clearly shocked Thailand's expat community who though they were tax-free unless officially working in Thailand. Indeed, the previous government, led by general Prayut Chan-o-cha, had marketed its long stay visas, especially Elite, precisely on the grounds that foreigners were mostly excused paying income tax here.

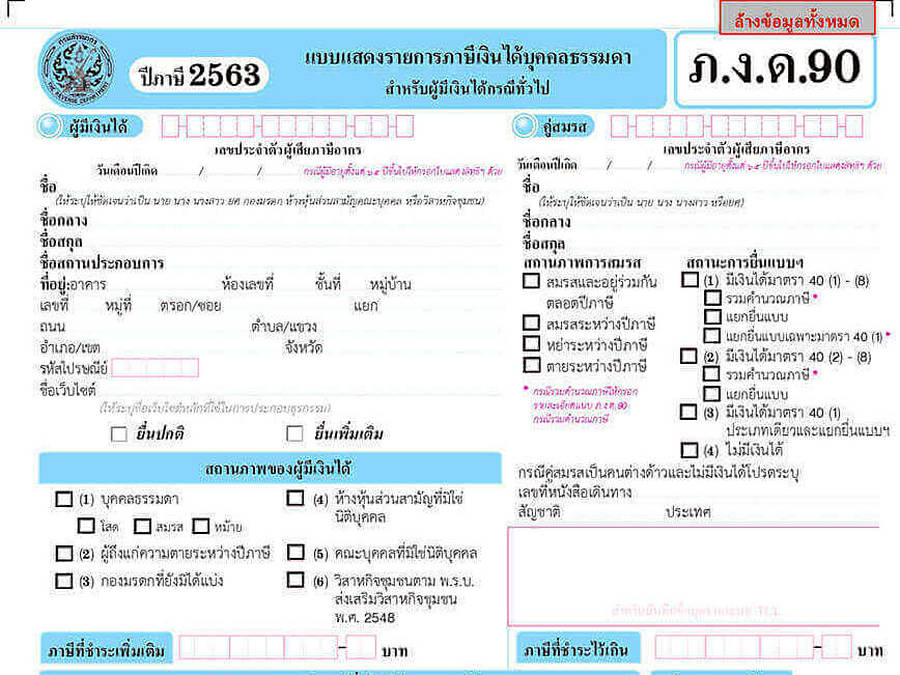

The first grey area for expats is registration. Contrary to some reports, there will be no deduction of funds on arrival. The system initially will be self-registration with taxable expats staying in Thailand longer than 180 days registering online with the revenue authority to receive a TIN or Tax Identification Number. Presumably, there will be further guidance on this procedure in later announcements. Of course, the self-registration is backed up by all the details of foreign transactions which are now easier to trace thanks to technological advancement. Wealthy expats are likely to choose a tax lawyer to fill in forms on their behalf.

The next ambiguity for foreigners is the double taxation agreement (DTA) which exists between 61 countries and Thailand. This means that some expats can benefit from Thai taxation relief by tax exemptions or tax credits where specific conditions are fulfilled. The most frequently example is pension income (state or employment) which is taxed in the source country. Not to mention that the income might well be taxed in the home country even though there is no formal agreement with Thailand. This whole area needs official clarification to avoid a bureaucratic nightmare and gross disillusionment.

The latest income tax rules won't apply to a foreigner residing in Thailand for less than 180 days in a year. If he or she transferred, say, four million baht to Thailand to purchase a condominium unit, personal income tax as recently defined would not operate. But an expat, living here for most of the year, could find a similar transfer might get tangled in the revenue net. Many other examples, beyond property purchases and sales, could be quoted to illustrate the devil will be in the detail. What is absolutely clear is that the Thai income tax tentacles are broadening beyond rich Thais earning cash abroad (or at home) and hiding it in offshore accounts or foreign banks.

For the past four decades, foreigners (unless working here with employment permits) have mostly been excused interference by the revenue department. It has been a discretion not a right. Some Thais have also been included in this category, for example overseas workers transmitting small amounts back to their families in Thailand. There is already much talk in expat circles about quitting Thailand. What is required is a policy statement by the revenue or Cabinet authorities even whilst acknowledging that a complex situation is in a trial period and may remain so for months. Sometimes silence is the best policy. Not in this case.

Inga kommentarer:

Skicka en kommentar