National —

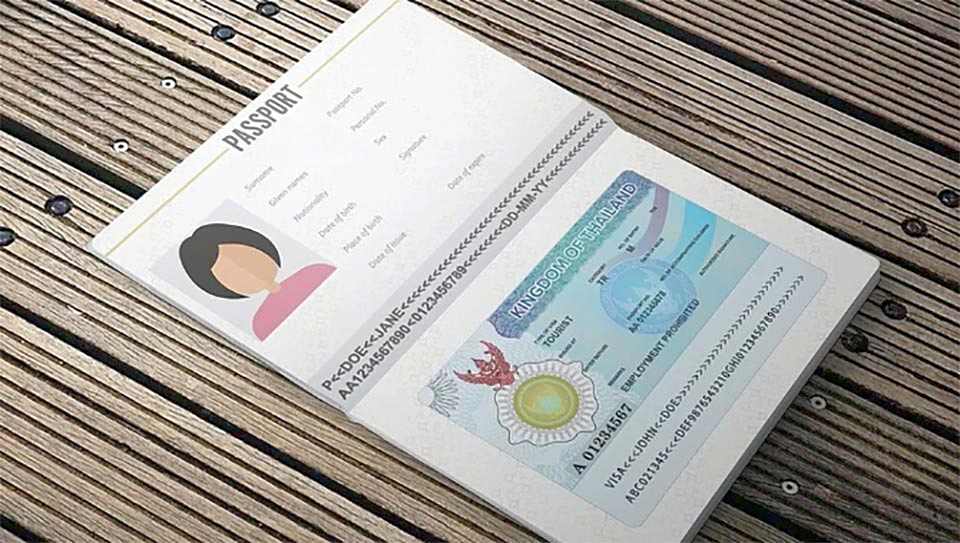

On July 15th, 2024, the Royal Gazette announced new regulations from the Ministry of Interior, granting visa exemptions for passport holders from 90 countries and territories for short-term visits up to 60 days.

This move aims to boost tourism and business travel as part of Thailand's economic recovery post-COVID-19.

Effective immediately, travelers from the following countries can enjoy visa-free entry for tourism, business, or short-term work: Albania, Andorra, Australia, Austria, Bahrain, Belgium, Bhutan, Brazil, Brunei, Bulgaria, Cambodia, Canada, China (including Hong Kong, Macao, and Taiwan), Colombia, Croatia, Cuba, Cyprus, Czech Republic, Denmark, Dominica, Dominican Republic, Ecuador, Estonia, Fiji, Finland, France, Georgia, Germany, Greece, Guatemala, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kazakhstan, South Korea, Kosovo, Kuwait, Laos, Latvia, Liechtenstein, Lithuania, Luxembourg, Malaysia, Maldives, Mauritius, Malta, Mexico, Monaco, Mongolia, Morocco, Netherlands, New Zealand, Norway, Oman, Panama, Papua New Guinea, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russia, San Marino, Saudi Arabia, Singapore, Slovakia, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Tonga, Trinidad and Tobago, Turkey, Ukraine, United Arab Emirates, United Kingdom, United States, Uruguay, Uzbekistan, and Vietnam.

This special measure underscores Thailand's effort to attract more international visitors and revitalize the economy by enhancing ease of travel. The initiative seeks to encourage foreign investments and tourism, recognizing their vital roles in economic stimulation.

Travelers wishing to extend their stay beyond 60 days can apply for a 30-day extension at the Immigration Office. Additionally, those seeking to change their visa type for other purposes can follow the standard procedures set by the Immigration Bureau.

This announcement, however, does not yet apply to other recent updates including visa on arrival for 31 countries, Destination Thailand Visa (DTV), and Post-Graduate Stay Extension, noted TPN.